snohomish property tax due date

Counties in Arizona collect an average of 072 of a propertys assesed fair market value as. 5006 239th PL SWThe Snohomish County Assessors Office is located in Everett Washington.

Second half taxes are due October 31.

. Appealing your property tax appraisal. This Executive Order only applies to residents who pay their. Searching Up-To-Date Property Records By County Just Got Easier.

Deadline will now be June 1 2020. Individual Program Review of a single area of property. Government Websites by CivicPlus.

The first installment is due September 1 of the property tax year. First half taxes are due April 30. The median property tax in Arizona is 135600 per year for a home worth the median value of 18770000.

The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. The Department of Revenue oversees the administration of property taxes at state and local levels.

Checking the Snohomish County property tax due date. Snohomish County Government 3000 Rockefeller Avenue Everett WA 98201 Phone. Snohomish County collects on average 089 of a propertys assessed fair market value as property tax.

In this mainly budgetary function county and local public leaders estimate annual spending. A 25 percent discount is allowed for first-half property taxes paid before September 1 and for second-half property taxes paid before March 1. The second installment is due March 1 of the next calendar year.

Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of. Types of county reports include. EVERETT Snohomish County March 30 2020 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June 1 2020.

Based on that 089 rate Snohomish County homeowners can expect to pay an average of 3009 a year in property. Please note that 1st Half Taxes are Due April 30th and 2nd Half Taxes are Due October 31st. Reporting upgrades or improvements.

When summed up the property tax burden all owners shoulder is created. Please refer to the back of your tax statement to determine eligibility or you may contact the Snohomish County Assessors Office at 425-388-3540 for additional information. Pierce County Assessor-Treasurer Mike Lonergan announced Monday that due date for first-half property tax payments would be extended to June 1 2020.

What is the property tax rate in Snohomish County. Spokane County has extended the deadline to June 15 th 2020. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined.

King Pierce and Snohomish County have extended the payment due date for property taxes to June 1 st 2020. For most homeowners that pay their taxes with their mortgage payment however there wont be any relief. State Sales and Use Tax.

Snohomish Property Tax Due Date. Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average of 092. Using this service you can view and pay them online.

Find All The Assessment Information You Need Here. Government Websites by CivicPlus. No interest will be charged on payments received by that date.

Everett is the county seat of Snohomish County where most local government offices are located. In our oversight role we conduct reviews of county processes and procedures to ensure compliance with state statutes and regulations. Local City County Sales and Use Tax.

Ad Unsure Of The Value Of Your Property. If paying after the listed due date additional amounts will be owed and billed. State Sales and Use Tax.

King Snohomish and Thurston counties are. Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June.

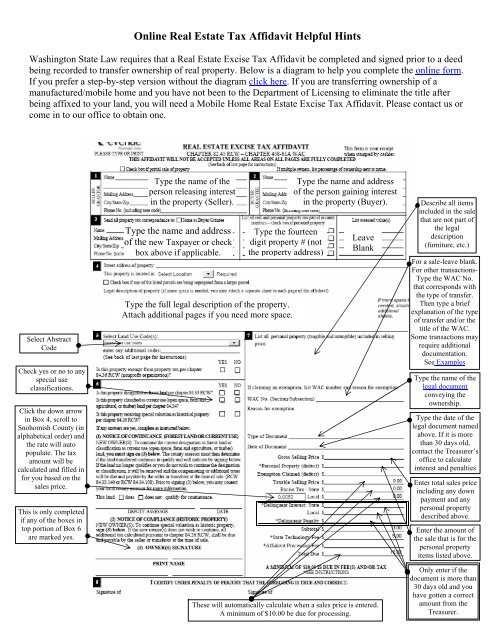

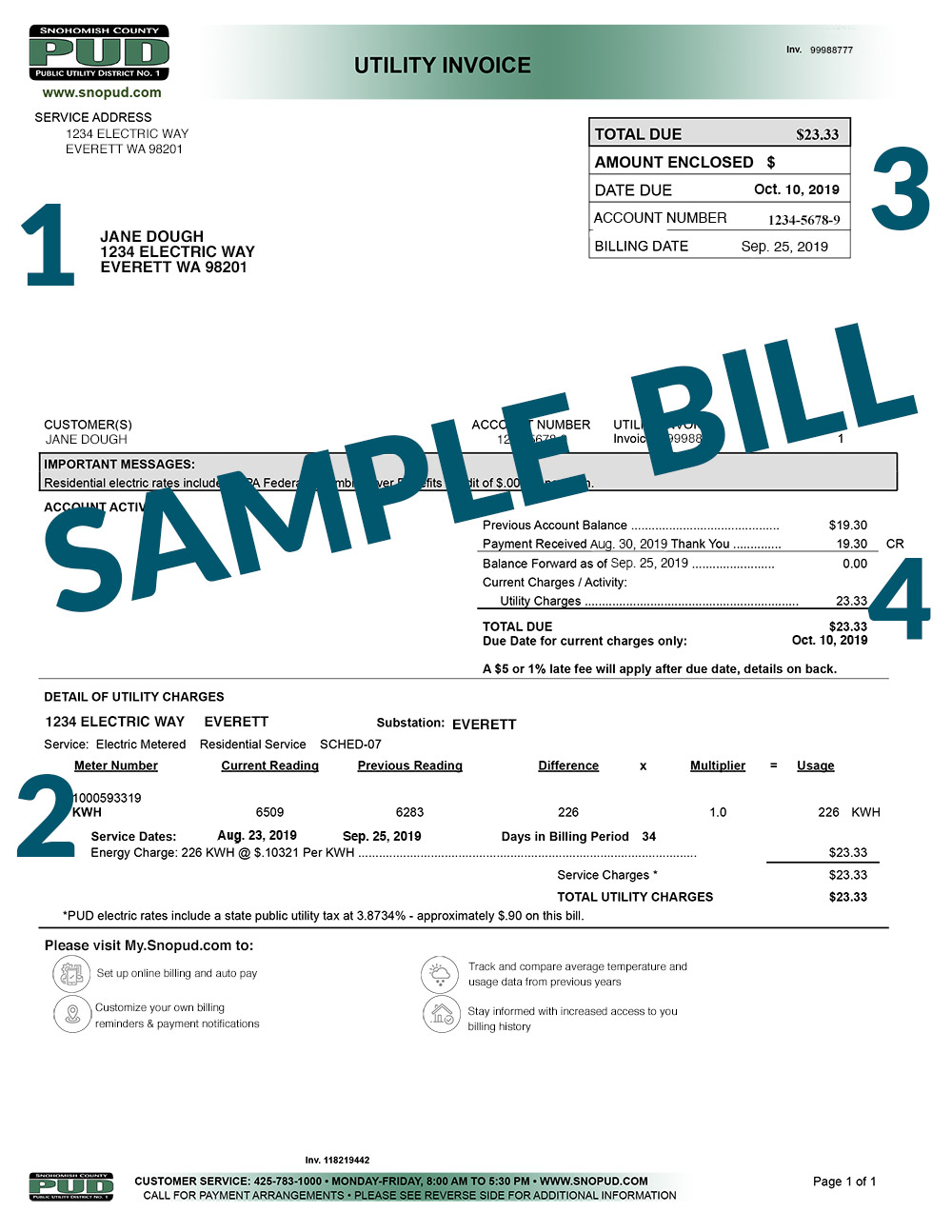

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Job Opportunities Sorted By Posting Date Descending Help Starts Here

Snohomish County Homelessness Rose To 10 Year High Count Shows Heraldnet Com

Analyst Says Housing Prices In Snohomish County Have Never Been Higher Puget Sound Business Journal

112 Avenue A Snohomish Wa 98290 Mls 1897775 Redfin

Online Real Estate Tax Affidavit Helpful Hints Snohomish County

Snohomish County Plots Out Light Rail Station Area Growth Wants Feedback Seattle Transit Blog

News Flash Snohomish County Wa Civicengage

Property Tax Interest Snohomish County Wa Official Website

My Billing Statement Snohomish County Pud

Snohomish Weighs Tax Breaks For Affordable Homes Though Results Vary Heraldnet Com

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

16m Grant To Speed Up Broadband To North Snohomish County Heraldnet Com

Individual Property Tax Deadline Extended To June 1 Lynnwood Times

16315 State Route 9 Se Snohomish Wa 98296 Snohomish Land Hwy 9 164th Lot 3 4 Loopnet

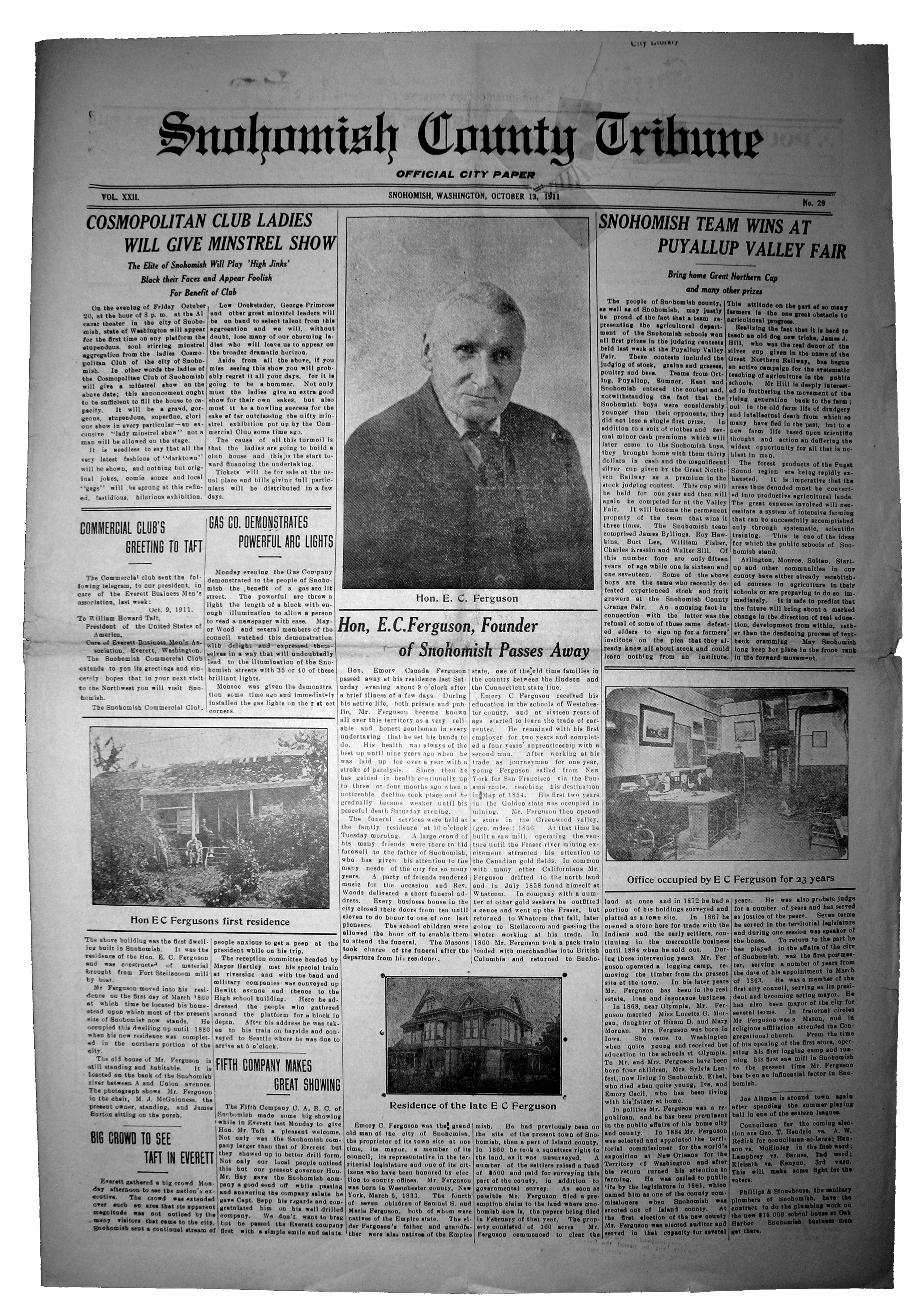

Snohomish Wa History Archives Snohomish Stories

Snohomish County Superior Court Efiling Form The Form In Seconds Fill Out And Sign Printable Pdf Template Signnow

Snohomish County Extends Deadline For Individual Property Taxpayers To June 1 My Edmonds News